David Bowden & Aaron Lynch – Ultimate Gann Course Coaching Online Classroom 2009

$4,976.00 Original price was: $4,976.00.$45.00Current price is: $45.00.

David Bowden & Aaron Lynch Ultimate Gann Course Coaching Online Classroom 2009 [Download]

1️⃣. What is Ultimate Gann Course Coaching Online Classroom 2009:

The Ultimate Gann Course teaches advanced market forecasting techniques. Led by David Bowden & Aaron Lynch, it focuses on Gann’s methods.

The program helps experienced traders improve market prediction and timing for better trading results.

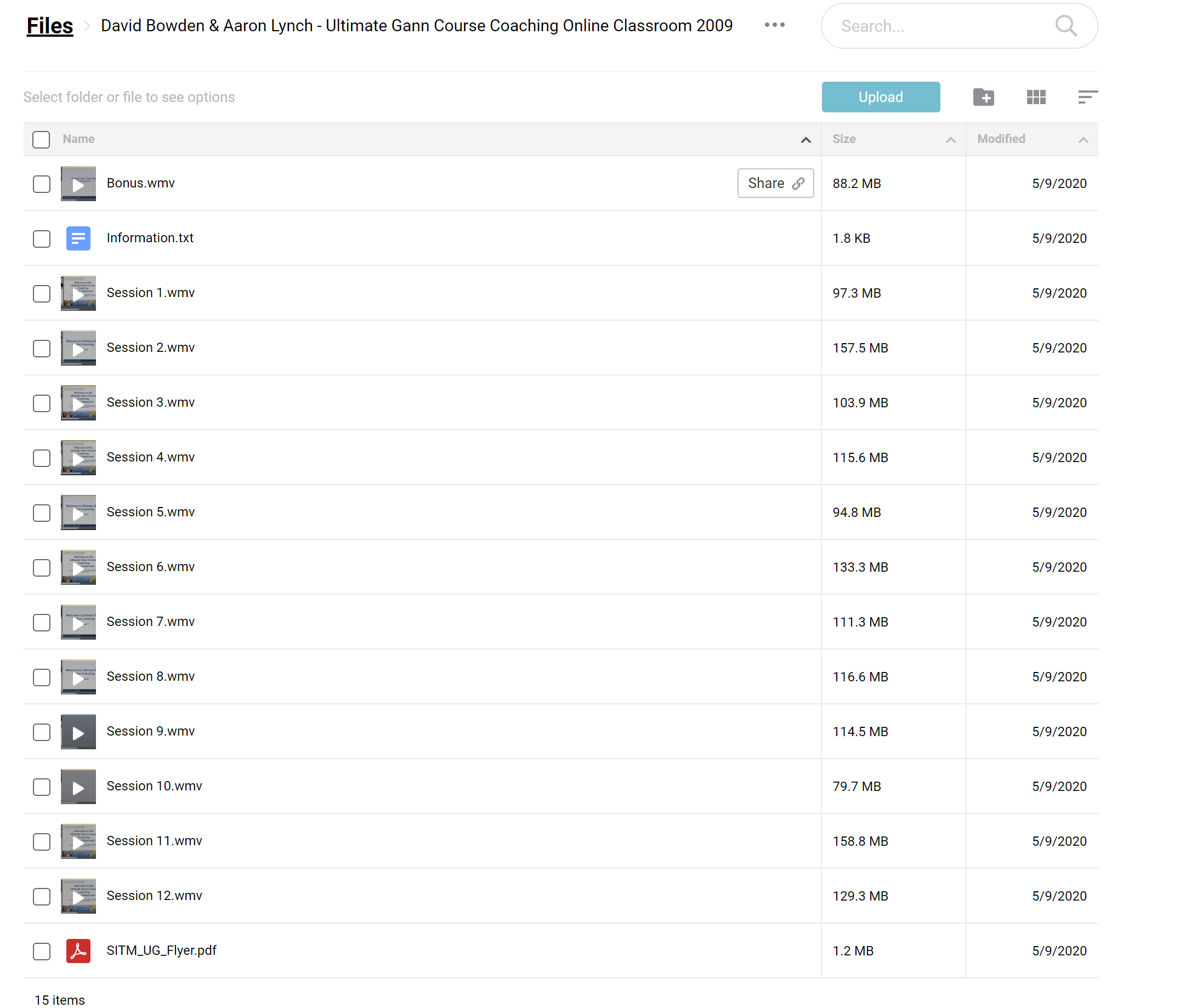

? PROOF OF COURSE

2️⃣. What you will learn in Ultimate Gann Course Coaching Online Classroom 2009:

The Ultimate Gann Course provides an immersive learning experience that equips traders with sophisticated analytical skills for predicting market trends. Here’s what you can expect to master:

- Understanding of Price Forecasting: Learn the intricacies of predicting market movements.

- Advanced Entry Strategies: Techniques for optimal entry points in trading.

- Mastering Stop Strategies: Knowledge on when to exit to protect gains or minimize losses.

- Application of Time by Degrees: Utilize this unique Gann technique to determine precise timing for trades.

- Squaring Time and Price: Discover how to align time and price for predictive accuracy.

- Insight into Pressure Dates: Learn to forecast significant market movements up to a year in advance.

These elements are presented in a structured format, providing clear pathways for applying these strategies in real-world trading scenarios.

3️⃣. Ultimate Gann Course Coaching Online Classroom 2009 Course Curriculum:

The Ultimate Gann Course curriculum is an expansive resource that dives deep into the methodologies that made Gann’s forecasts so renowned. This detailed course includes:

- 322 Page Hard Cover Manual: A comprehensive guide covering all theoretical aspects of Gann’s trading strategies.

- Nine Instructional DVDs: Step-by-step lessons demonstrating practical applications of the covered theories.

- SPI 200 Daily Bar Chart (3m long): Essential tool for visual analysis of market trends.

- Daily Bar Chart (1 x 0.7m): Additional charting resource to support decision-making.

- 1950 – 1951 Soybeans Chart (x2): Specific historical data to enhance learning about commodity trading.

- 30, 45, and 90 Vibration Wall Charts: These charts help identify critical market vibrations for better trading decisions.

- Day Counter: A device to track trading days, crucial for timing.

- DVD Reference Cards: Quick-reference materials to aid in learning.

- Proprietary Trading Plans: Exclusive access to proven trading strategies developed by David Bowden.

- Trading Record Sheets: Organize and track your trades for better analysis and accountability.

- Multi-Media CD ROM: Interactive learning tools for an engaging study experience.

Each component is designed to build on the previous, ensuring a comprehensive understanding of advanced Gann techniques that can be applied effectively in the trading markets.

4️⃣. Who is David Bowden & Aaron Lynch?

David Bowden, the founder of Safety in the Market, is a distinguished figure in the world of trading, renowned for his deep understanding of Gann techniques. Since launching his company in 1989, David has been a pivotal force in educating traders through his seminars and publications.

His journey began with a profound realization of his knowledge during a seminar in the U.S. in the 1980s, which propelled him to teach others about Gann’s methodologies. David is also known for his successful personal trading, notably paying for a new house in cash from a single week’s trading gains. Although he retired in 2000, his legacy continues through the courses and teachings he has established.

Aaron Lynch, the Chief Strategist for Safety in the Market, has been an instrumental educator and strategist since he began his trading career in 1999. Aaron specializes in trading shares, options, and commodities, with a particular affinity for oil futures.

His contributions to the field are recognized through regular features in financial publications and as a commentator on financial matters. Aaron’s approach to trading emphasizes the critical role of education in achieving success in the stock market, guiding new and experienced traders alike through complex market dynamics.

5️⃣. Who should take this course?

This course is designed for a diverse group of individuals who are serious about advancing their trading skills:

- Beginner Traders: Those who have completed preliminary courses like the Smarter Starter Pack and seek to delve deeper.

- Experienced Market Players: Seasoned traders looking to refine their forecasting and market analysis skills.

- Financial Analysts: Professionals who require advanced strategies in market prediction for better decision-making.

- Gann Enthusiasts: Individuals fascinated by Gann’s methods and eager to apply these principles in practical trading.

The course aims to equip participants with the tools to not only understand the market but also to make informed and strategic decisions based on Gann’s forecasting techniques.

6️⃣. Frequently Asked Questions:

Q1: What is forecasting in simple an term?

Forecasting is the process of making predictions about future events based on past and present data. In trading, this involves using historical market data to predict future price movements and trends.

Q2: Why is market forecasting important?

Market forecasting is crucial because it helps traders and investors anticipate market movements, allowing them to make informed decisions on when to buy or sell. Accurate forecasting can significantly increase the chances of making profitable trades.

Q3: What are the major Gann levels?

The major Gann levels are specific angles and price points on charts that Gann theory suggests can indicate significant market movements. These include the 1×1 angle, which represents a one-point move in price for every unit of time, and other critical angles like 1×2, 2×1, and 1×3.

Q4: How accurate is the Gann theory?

The accuracy of the Gann theory varies based on the skill and experience of the trader using it. While some traders find it highly effective, others may not achieve the same level of success. Its effectiveness often depends on the trader’s ability to correctly interpret and apply the techniques.

Q5: What is a price prediction model?

A price prediction model is a mathematical or statistical model used to forecast future prices based on various factors, including historical price data, market trends, economic indicators, and more. These models aim to provide traders with predictions on where the market prices might head, assisting in strategic planning and decision-making.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet