Jeffrey Kennedy Package

$189.00 Original price was: $189.00.$39.90Current price is: $39.90.

Jeffrey Kennedy Package Course [Download]

1️⃣. What is Jeffrey Kennedy Package:

The Jeffrey Kennedy Package teaches market analysis and chart reading. It covers Kennedy’s successful trading methods and techniques.

The course aims to help identify high-probability trading opportunities. It focuses on practical chart analysis skills for better market understanding.

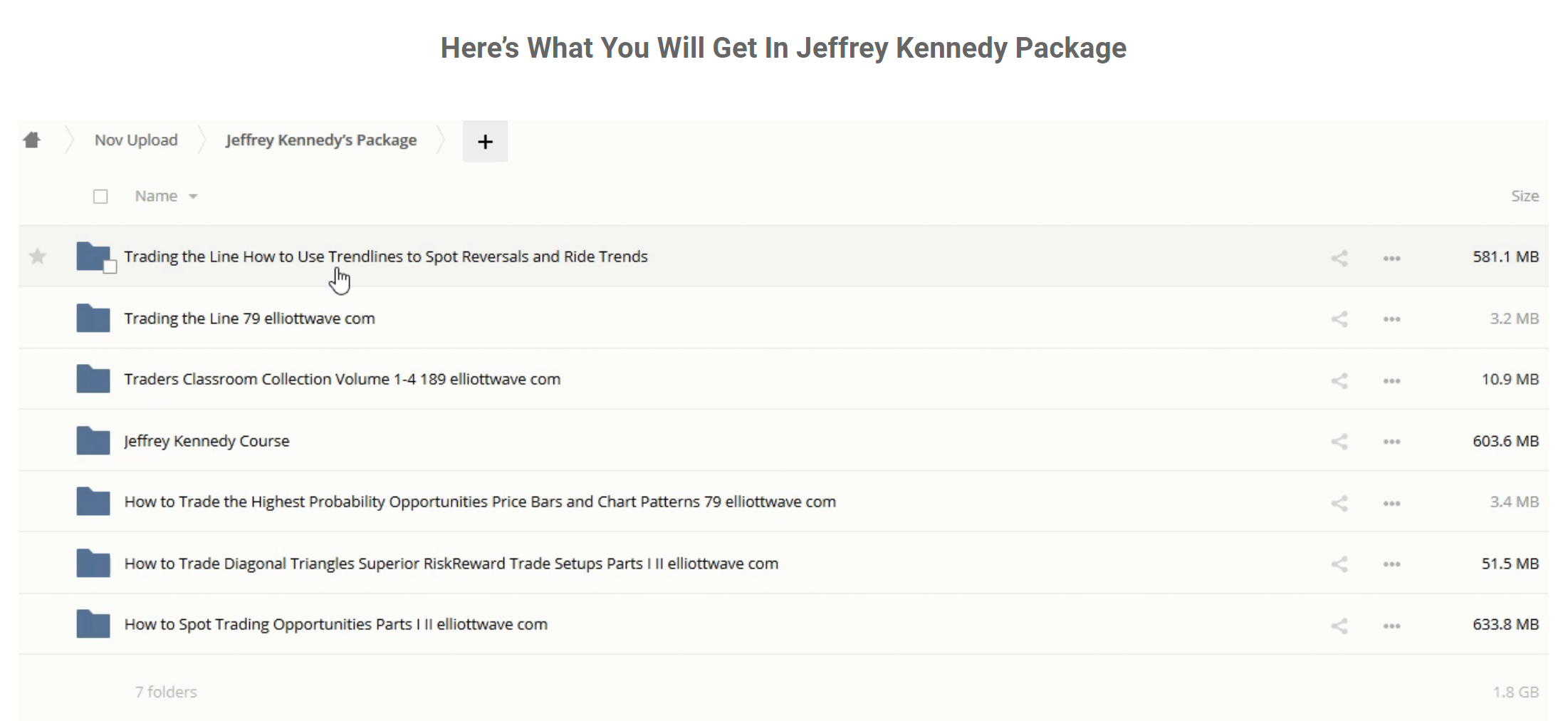

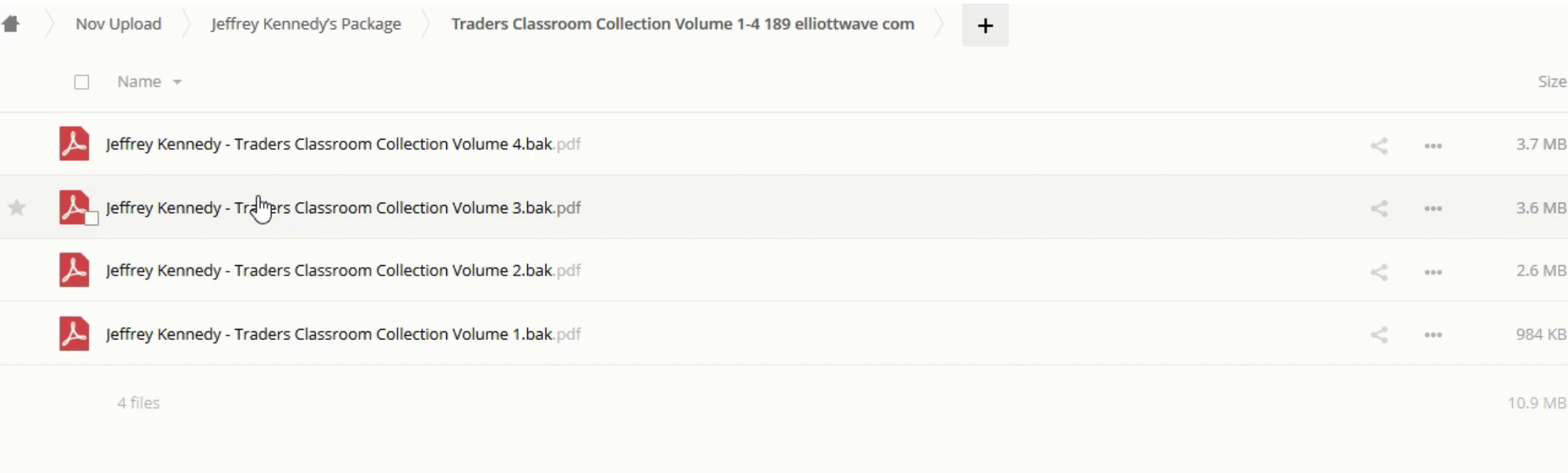

? PROOF OF COURSE

2️⃣. What you will learn in Jeffrey Kennedy Package:

In the Jeffrey Kennedy Package, you’ll embark on a comprehensive journey through the world of trading and technical analysis. Here’s what each course offers:

- Fundamentals of Technical Analysis: Grasp the basics and build a strong foundation in technical analysis principles.

- Advanced Trading Strategies: Learn advanced techniques to enhance your trading skills, including the use of Elliott Wave theory for market prediction.

- Practical Trading Tips: Practical insights on how to use moving averages, trendlines, and chart patterns for effective trading.

- Risk Management: Master techniques to manage risk and improve the risk-reward ratio in your trades.

- Identifying Market Opportunities: Develop the skill to identify and capitalize on trading opportunities using Jeffrey’s proven methods.

- Comprehensive Trading Tools: Explore the extensive tools and resources that Jeffrey Kennedy uses for market analysis.

This course is designed to elevate your trading skills and enable you to navigate the markets with confidence.

3️⃣. Jeffrey Kennedy Package Course Curriculum:

- How to Trade the Highest Probability Opportunities. Moving Averages

- Best of Traders Classroom

- The Ultimate Technical Analysis Handbook

- Traders Classroom Collection Volume 1-4

- Trading the Line

- Trading the Line. How to Use Trendlines to Spot Reversals and Ride Trends $29

- How to Spot Trading Opportunities (Parts I & II)

- How to Trade Diagonal Triangles. Superior Risk/Reward Trade Setups (Parts I & II)

- How to Trade the Highest Probability Opportunities, Price Bars and Chart Patterns

Explore the Jeffrey Kennedy Package for a comprehensive learning journey in trading and technical analysis. This course suite includes essential modules on moving averages for timing market entries and exits, detailed explorations of practical strategies in the extensive Traders Classroom series, and fundamental insights from the Ultimate Technical Analysis Handbook.

Learn to harness the power of trendlines with the Trading the Line courses, where identifying reversals and sustaining trends are made clear. Enhance your ability to spot high-potential trading opportunities through advanced analysis of price bars and chart patterns. Additionally, delve into specialized techniques with the How to Trade Diagonal Triangles series, focusing on superior risk-reward setups.

Each component of the curriculum is tailored to build your proficiency in technical analysis, ensuring you are well-equipped to manage and capitalize on market movements effectively.

4️⃣. Who is Jeffrey Kennedy?

Jeffrey Kennedy is a renowned figure in the field of technical analysis, boasting extensive credentials and a rich professional background. With over two decades of experience, he holds prestigious certifications such as MSTA, CFTe, CMT, and CEWA. Kennedy’s expertise is recognized globally, making him a sought-after analyst and educator.

As the chief technical analyst at Water Street Advisory, Inc., Jeffrey Kennedy has helped countless traders and investors understand market dynamics through technical analysis. His contributions to the field are not only practical but also educational. He has co-authored significant works like the “Visual Guide to Elliot Wave Trading,” enhancing traders’ skills worldwide.

Kennedy’s career is highlighted by his role as an adjunct instructor at the Georgia Institute of Technology, where he imparted knowledge in the Quantitative and Computational Finance program. He is also an active member of several prestigious associations including the Market Technicians Association and the International Federation of Technical Analysts.

Beyond his professional pursuits, Jeffrey Kennedy is dedicated to education and philanthropy, contributing to various educational foundations and initiatives aimed at advancing the field of market analysis.

5️⃣. Who should take this course?

Ideal Candidates for the Jeffrey Kennedy Package:

- Aspiring Traders: Beginners seeking a solid foundation in technical analysis to start trading with confidence.

- Experienced Market Participants: Seasoned traders and investors looking to enhance their analytical skills and incorporate advanced strategies like Elliott Wave theory.

- Financial Analysts: Professionals in finance who wish to deepen their technical analysis capabilities for better market predictions.

- Risk Managers: Individuals interested in better managing market risks through improved trading strategies and risk-reward setups.

- Educators in Finance: Academic professionals and trainers aiming to update their curriculum with cutting-edge analytical techniques.

This course is tailored to equip you with the knowledge and tools needed to excel in various trading environments, ensuring you can make informed decisions and optimize your trading performance.

6️⃣. Frequently Asked Questions:

Q1: What are the basic trade setups?

Basic trade setups include trend following, breakout trading, and reversal patterns. These foundational strategies are essential for identifying potential market movements and making informed trading decisions.

Q2: Which trading style is most profitable?

The profitability of a trading style depends on the trader’s knowledge, risk management, and adaptability. However, day trading and swing trading are popular for their potential to generate significant profits when executed with strong strategies and discipline.

Q3: What does every day trader need?

Every day trader needs a reliable trading platform, real-time market data, analytical tools, a well-defined trading strategy, and effective risk management techniques to succeed in the fast-paced trading environment.

Q4: How do you find opportunities in trading?

Trading opportunities can be identified by analyzing market trends, using technical indicators like moving averages and trendlines, and staying informed about financial news that can impact market conditions.

Q5: Do professional traders use trendlines?

Yes, professional traders frequently use trendlines as they are fundamental tools in technical analysis. Trendlines help in identifying support and resistance levels, spotting directional trends, and making strategic trading decisions based on market behavior.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet