Investopedia Academy – Options for Beginners

$199.00 Original price was: $199.00.$39.90Current price is: $39.90.

Investopedia Academy Options for Beginners Course [Instant Download]

1️⃣. What is Options for Beginners:

The Options for Beginners course by Investopedia Academy teaches practical options trading strategies. It covers essential terms like calls, puts, risk management, and expiration dates.

The course includes over five hours of video lessons, exercises, and interactive content. Students receive workbooks and an Excel spreadsheet for option valuation to enhance learning and application.

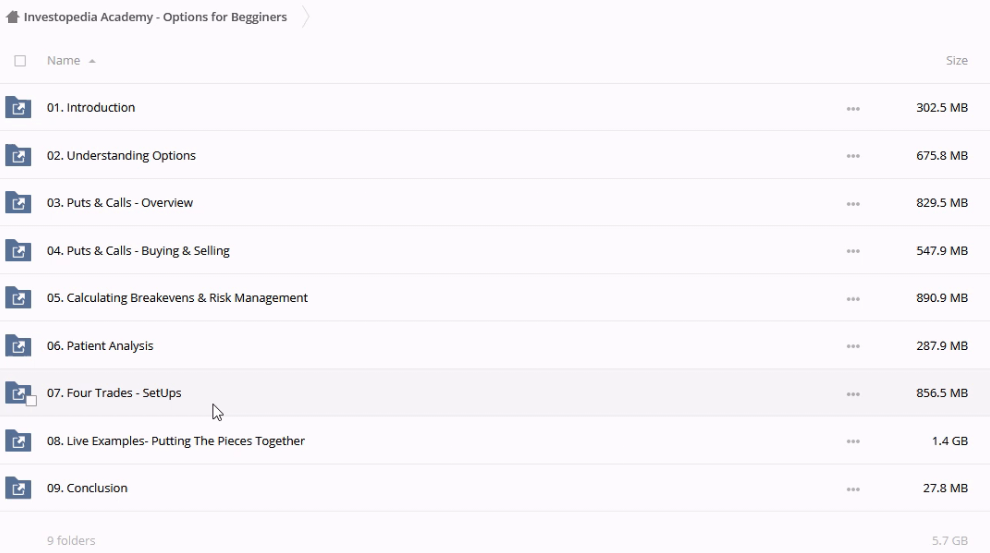

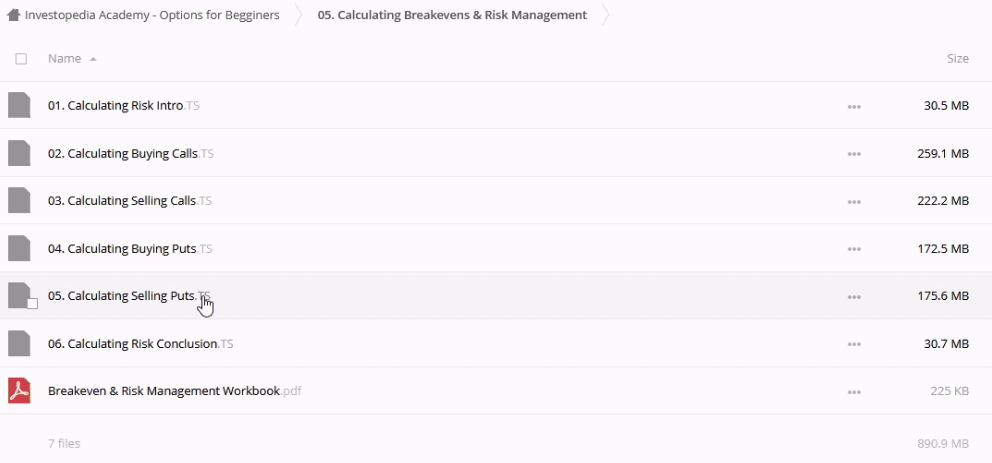

? PROOF OF COURSE

2️⃣. What you will learn in Options for Beginners:

- Options Basics: Learn key terms and concepts like intrinsic and time value.

- Portfolio Integration: Use options for hedging and enhancing returns.

- Call and Put Strategies: Understand buying/selling calls and puts.

- Expiration and Value: Interpret dates and option value components.

- Risk Management: Master breakeven calculations and risk mitigation.

- Learning Resources: Access video lessons, exercises, and tools.

- Timing and Volatility: Understand how these factors affect trading.

- Core Strategies: Learn four essential options trading setups.

3️⃣. Options for Beginners Course Curriculum:

- Module 1: Introduction

- Module 2: Understanding Options

- Module 3: Puts & Calls – Overview

- Module 4: Puts & Calls – Buying & Selling

- Module 5: Calculating Breakevens & Risk Management

- Module 6: Patient Analysis

- Module 7: Four Trades – SetUps

- Module 8: Live Examples – Putting The Pieces Together

- Module 9: Conclusion

4️⃣. Who is Investopedia Academy?

Investopedia Academy is part of Investopedia, a leading financial media website established in 1999 by Cory Wagner and Cory Janssen. Investopedia has become a trusted source for financial education, offering investment dictionaries, advice, reviews, ratings, and comparisons of financial products. As part of the Dotdash Meredith family, Investopedia Academy focuses on providing high-quality educational technology through a range of online courses.

Investopedia Academy’s mission is to empower individuals with the knowledge they need to make informed financial decisions. The academy offers comprehensive courses taught by industry experts, including options trading, personal finance, and more. Investopedia Academy leverages the vast resources and expertise of Investopedia to create engaging, practical, and accessible learning experiences for beginners and experienced traders alike.

5️⃣. Who should take this course?

The Options for Beginners course is designed for:

- Intermediate Traders: Those with some trading experience looking to expand their knowledge.

- Experienced Traders: Traders seeking to enhance their options trading strategies.

- Individuals with a Brokerage Account: A prerequisite to fully benefit from the course material.

6️⃣. Frequently Asked Questions:

Q1: What are the basics of options?

Options are financial instruments that give you the right, but not the obligation, to buy or sell an asset at a specific price before a certain date. There are two main types: calls and puts. Calls give you the right to buy, and puts give you the right to sell.

Q2: What are puts and calls?

Puts and calls are the two primary types of options. A call option allows you to buy an asset at a specified price within a certain period, while a put option allows you to sell an asset at a specified price within a certain period.

Q3: Which option strategy is best for beginners?

For beginners, simple strategies like buying calls or puts are recommended. These strategies are straightforward and allow you to limit your risk to the amount you paid for the option.

Q4: How do you calculate the break-even point?

The break-even point for a call option is the strike price plus the premium paid. For a put option, it’s the strike price minus the premium paid. This calculation helps you know when your trade starts to be profitable.

Q5: What is the time value of an option?

The time value of an option is the extra amount you pay above the intrinsic value due to the time remaining until expiration. It reflects the potential for the option to gain value before it expires.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet