Cue Banks – Wall Street Academy Training

$120.00

Cue Banks Wall Street Academy Training Course [Instant Download]

1️⃣. What is Cue Banks’ Wall Street Academy Training:

Wall Street Academy Training by Cue Banks teaches Forex trading. It covers basics to advanced strategies, requiring no prior experience.

The course includes software setup, market analysis, risk management, and trading psychology. It features different trading styles through collaboration with Forever In Profit colleagues.

? PROOF OF COURSE

2️⃣. What you will learn in Wall Street Academy Training:

In the Wall Street Academy Training course, you will embark on a journey through the complex yet rewarding world of Forex trading. Here are the key learnings you can expect:

- Foundational Knowledge: Basics of Forex trading, currency pairs, and market influences.

- Technical Analysis: Market trend analysis using indicators like Fibonacci retracements and support/resistance levels.

- Risk Management: Skills to preserve capital and maximize returns through position sizing and stop-loss orders.

- Trading Psychology: Overcoming emotional decision-making and psychological barriers.

- Platform Setup: Guidance on installing and configuring MetaTrader 4 (MT4) and other trading tools.

- Advanced Analysis: Techniques like Ichimoku Kinko Hyo and naked chart trading.

- Live Trading: Participate in live sessions and webinars for practical market experience.

Each module is designed to build progressively, ensuring you develop both the confidence and competence needed to trade independently and successfully in the Forex market.

3️⃣. Wall Street Academy Training Course Curriculum:

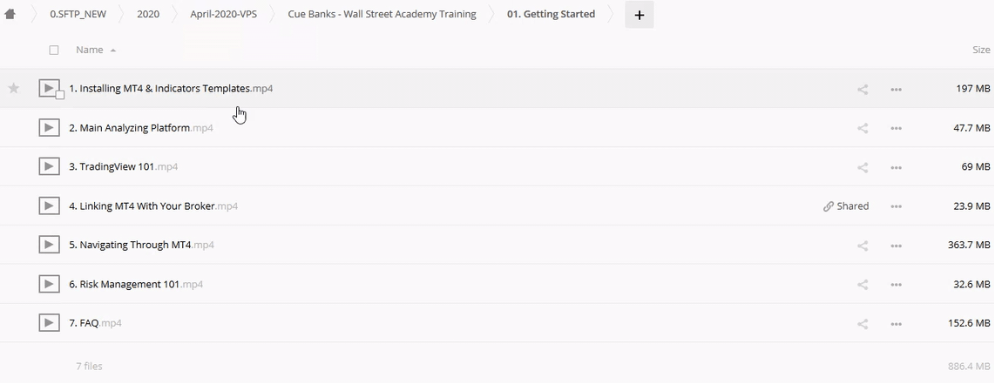

✅ Module 1: Getting Started

- Installing MT4 & Indicators Templates

- Main Analyzing Platform

- TradingView 101

- Linking MT4 With Your Broker

- Navigating Through MT4

- Risk Management 101

- FAQ

✅ Module 2: Psychology

- The Greed Effect

- Knowing Your Trading Style

- Fear Of The Market

- Revenge Trading

- Demo VS Live

- PSYCH2.0 INTRO W DGAR TORRES

- THE 4 FEARS

✅ Module 3: Phrase One

- Identifying The Trend 2.0

- Support and Resistance

- Support and Resistance 2.0

- Supply and Demand

- Drawing Trendlines

✅ Module 4: Phrase Two

- Using Fibonacci 1.0

- Drawing Market Structure

- Market Structure 2.0

- Using Fibonacci 2.0

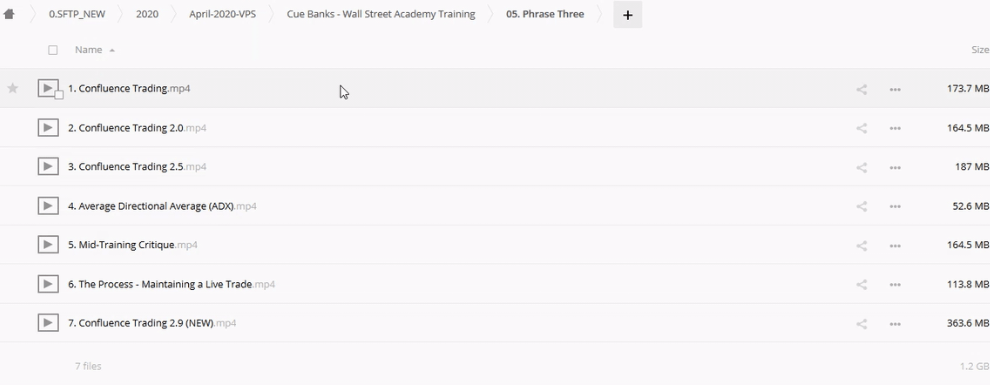

✅ Module 5: Phrase Three

- Confluence Trading

- Confluence Trading 2.0

- Confluence Trading 2.5

- Average Directional Average (ADX)

- Mid-Training Critique

- The Process – Maintaining a Live Trade

- Confluence Trading 2.9 (NEW)

✅ Module 6: Phrase Four

- Ichimoku Kinko Hyo

- Using Donchian Channels

- Trading With Naked Charts

- Pivot Points

- Using Channels To Catch Breakouts

4️⃣. Who is Cue Banks?

Quillan Roberto Black, widely known as Cue Banks, is a revered figure in the Forex trading world. Born in Mandeville, Jamaica, and later relocating to the United States, Cue has carved a unique path in the financial markets that distinguishes him from the conventional trader. His journey began in his early twenties when he started investing in stocks, which eventually led him to discover Forex trading—a field where he truly excelled.

Cue’s initial exposure to Forex was in 2013 while trading stock options. Despite the complexities of the market, his previous experience and inherent analytical skills allowed him to grasp Forex trading concepts quickly. His breakthrough came from not just understanding the market but mastering it to the extent that within his first week of trading, he was making significant profits. This success was a turning point, confirming his belief that there was more to life than a routine 9-to-5 job.

In 2015, Cue Banks founded “Forever In Profit,” an educational platform aimed at teaching others how to trade in the Forex market. The platform has since grown and merged under the umbrella of Wall Street Academy, where Cue, along with his partners Ryan Gilpin and Rico Villarreal, offers varied perspectives on trading, thus enriching the learning experience for their students.

His teaching style is direct and practical, focusing on psychological training, risk management, and technical analysis, which are critical to trading success. Cue is not just a trader; he is a mentor who is deeply committed to his students’ success, sharing not only his trading strategies but also instilling the discipline and psychological resilience necessary to thrive in the markets.

5️⃣. Who should take this course?

- Entrepreneurs and Business Owners: Individuals looking to diversify their income streams will find valuable strategies to apply in the volatile Forex market.

- Aspiring Traders: If you’re new to Forex or have had limited success, this course provides a structured path from foundational knowledge to advanced trading techniques.

- Seasoned Investors: Experienced traders seeking new methodologies or deeper insights into different trading styles will benefit from the diverse perspectives offered.

- Career Changers: For those looking to pivot into a trading career, this course offers the necessary tools and knowledge to make a confident transition.

- Students of Finance: Finance students or recent graduates wanting to augment their theoretical studies with practical trading skills will find this course particularly enlightening.

- Risk Managers: Professionals in risk management looking to deepen their understanding of market dynamics and risk mitigation techniques in trading.

This course is tailored for anyone who is serious about turning Forex trading into not just a hobby, but a profitable long-term business. Cue Banks and his team provide not only the educational foundation but also mentorship and support to ensure you have all the tools to succeed in the Forex market.

6️⃣. Frequently Asked Questions:

Q1: What is forex mentorship?

Forex mentorship involves learning from an experienced trader who guides you through the intricacies of the Forex market. It includes practical advice, strategies, and often hands-on trading experience. Mentorship can accelerate your learning curve and help you navigate common pitfalls in trading.

Q2: Can I trade Forex with $100?

Yes, you can start trading Forex with as little as $100. Most Forex brokers offer flexible trading options and leverage, which allows you to trade significant amounts with a small capital. However, it’s important to manage risks wisely, especially when starting with a small amount.

Q3: How do you Analyse currency market?

Analyzing the currency market involves studying economic indicators, world events, and market sentiment. Traders often use technical analysis tools like charts, patterns, and indicators to predict future movements and make trading decisions.

Q4: What is the best risk management in forex?

The best risk management strategy in Forex involves setting stop-loss orders to limit potential losses, using leverage cautiously, and never risking more than 1-2% of your trading account on a single trade. Proper risk management ensures longevity and stability in your trading career.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet