Stephen W.Bigalow – 12 Major Candlestick Signals

$43.00

Stephen W. Bigalow 12 Major Candlestick Signals Course [Instant Download]

? PROOF OF COURSE

1️⃣. What is Stephen W. Bigalow 12 Major Candlestick Signals:

Stephen W. Bigalow’s 12 Major Candlestick Signals course teaches traders to analyze markets using key candlestick patterns. It covers 12 essential patterns, explaining their appearance and the market psychology behind them.

The course helps identify market turning points, giving traders an edge. It’s useful for improving trading strategies and analytical skills, aiming to enhance investment decisions through candlestick analysis.

2️⃣. What you will learn in 12 Major Candlestick Signals:

In the 12 Major Candlestick Signals course, students will dive deep into the world of candlestick charting, gaining insights that are directly applicable to real-world trading. Here’s what you can expect to learn:

- Foundational Concepts: Understanding the basics of candlestick construction—recognizing the body, shadows, and their significance in market predictions.

- Pattern Recognition Skills: Detailed walkthroughs of each of the 12 major signals including the Hammer, Hanging Man, Bullish and Bearish Engulfing, among others.

- Trading Psychology: Insights into how candlestick patterns reflect underlying investor sentiment and market dynamics.

- Strategic Application: How to apply knowledge of these signals to predict potential market moves and make trades with higher confidence.

- Risk Management: Techniques for using candlestick signals to set stop-loss orders and manage risk effectively.

Each lesson is structured to build your knowledge incrementally, ensuring you grasp the intricacies of candlestick charting and can apply this knowledge to enhance your trading strategies.

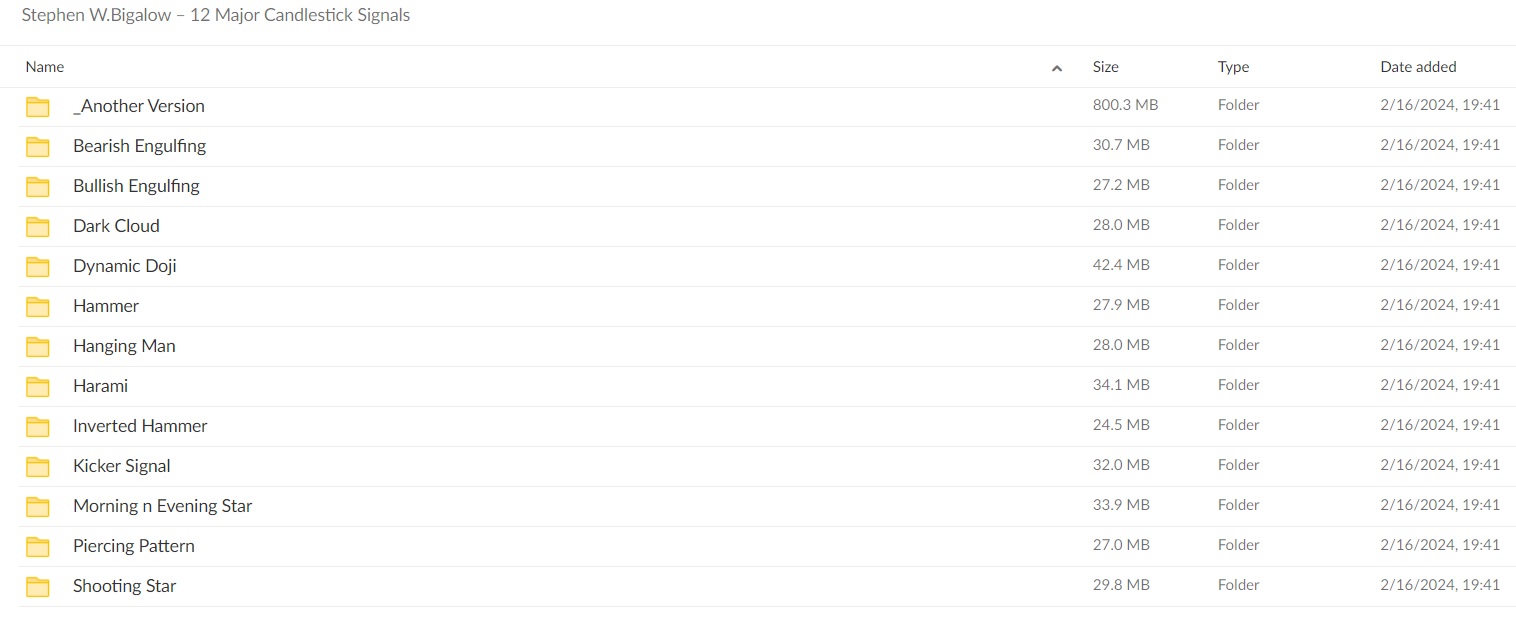

3️⃣. 12 Major Candlestick Signals Course Curriculum:

- Module 1: Another Version

- Module 2: Bearish Engulfing

- Module 3: Bullish Engulfing

- Module 4: Dark Cloud

- Module 5: Dynamic Doji

- Module 6: Hammer

- Module 7: Hanging Man

- Module 8: Harami

- Module 9: Inverted Hammer

- Module 10: Kicker Signal

- Module 11: Morning n Evening Star

- Module 12: Piercing Pattern

- Module 13: Shooting Star

4️⃣. Who is Stephen W. Bigalow?

Stephen W. Bigalow is an esteemed figure in the field of financial trading with over forty-five years of investment experience. His career began on Wall Street, where he spent eight impactful years with prestigious firms such as Kidder Peabody & Company, Cowen & Company, and Oppenheimer & Company. His expertise was further honed with fifteen years in commodity trading and twelve years in real estate investing.

Bigalow holds a business and economics degree from Cornell University, which laid the foundation for his analytical approach to market trends. Over the past two decades, he has been a sought-after lecturer at Cornell and various private educational investment functions, sharing his deep understanding of market dynamics.

He is the author of several influential books on Candlestick trading, including “Profitable Candlestick Trading” and “High Profit Candlestick Patterns,” which are considered essential reading for investors wanting to leverage market sentiment to maximize profits. His work emphasizes practical strategies combined with investor psychology to help traders and investors make informed decisions devoid of emotional biases.

As an affiliate of the Market Technicians Association and a member of the American Association of Professional Technical Analysts, Bigalow is revered as the “professional’s professional,” advising money managers, hedge funds, and mutual funds. His teachings distill complex concepts into actionable knowledge, making him a pivotal resource for both novice and expert traders.

5️⃣. Who should take this course?

This course is designed for a broad audience, ranging from beginners in the trading world to seasoned investors seeking to refine their analytical skills. Here are the key groups who will benefit most:

- Novice Traders: Gain a solid foundation in the basics of candlestick patterns and how they can signal significant market movements.

- Experienced Investors: Enhance your understanding of advanced candlestick patterns and the psychological aspects that drive market trends.

- Financial Professionals: Brokers, analysts, and other market participants looking to deepen their technical analysis skills and improve their trading strategies.

- Academic Students: Individuals pursuing studies in finance or economics who wish to apply technical analysis to real-world scenarios.

- Casual Learners: Anyone with an interest in stock trading looking to learn about the predictive power of candlestick signals.

Each participant will find the course materials tailored to fostering a comprehensive understanding of market behaviors, enabling more confident and informed trading decisions.

6️⃣. Frequently Asked Questions:

Q1: What is the most successful candlestick pattern?

The Hammer and Bullish Engulfing patterns are considered among the most successful due to their reliability in signaling potential bullish reversals. These patterns are best used when confirmed with other indicators, enhancing their predictive power.

Q2: Which chart is best for trading, especially for day traders?

For day traders, the candlestick chart is typically the most useful as it provides visual insights into market sentiment within short time frames, allowing traders to make quick decisions based on comprehensive data.

Q3: Do professional traders use candlestick patterns?

Yes, many professional traders use candlestick patterns as part of their trading strategy. These patterns help in predicting market movements by indicating potential reversals or continuations of trends, providing a tactical edge in decision-making.

Q4: What is the rarest candlestick pattern and why is it significant?

The Abandoned Baby is one of the rarest candlestick patterns. It is significant because it strongly indicates a potential reversal in the market. This pattern, due to its rarity, often commands attention from traders seeking to capitalize on new trends.

Q5: How do you read candlesticks like a pro?

Reading candlesticks like a pro involves understanding the context within which the patterns form. Pros look for patterns like Doji, Hammer, or Engulfing in conjunction with other technical indicators, market trends, and volumes to make informed trading decisions. Mastery comes from practice and continuous learning.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Ricky Gutierrez – Learn Plan Profit – A-Z Blueprint To Trading In The Stock Market

Stock Forex Options - Trading

Nehemiah M. Douglass & Cottrell Phillip – Forex Fortune Factory

Stock Forex Options - Trading

David Bowden & Aaron Lynch – Ultimate Gann Course Coaching Online Classroom 2009

Stock Forex Options - Trading

Reviews

There are no reviews yet