Wyckoff VSA – Point and Figure Mentorship Course

$695.00 Original price was: $695.00.$92.15Current price is: $92.15.

Wyckoff VSA Point and Figure Mentorship Course [Download]

1️⃣. What is Point and Figure Mentorship Course:

The Wyckoff VSA Point and Figure Mentorship Course teaches professional-level trading skills. It covers Volume Spread Analysis for interpreting market forces.

The course aims to help traders understand institutional investor strategies. It provides tools to analyze market dynamics using Wyckoff methods.

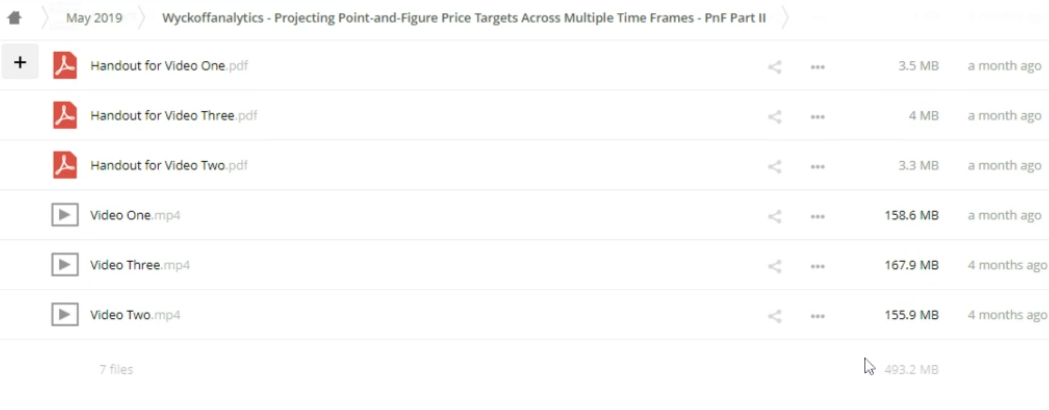

? PROOF OF COURSE

2️⃣. What you will learn in Point and Figure Mentorship Course:

In this course, you will gain in-depth knowledge and practical skills including:

- Understanding the foundational concepts of Volume Spread Analysis.

- Applying VSA techniques to identify market manipulation.

- Utilizing advanced trading tools integrated with popular platforms like MT4 and NinjaTrader.

- Engaging with live trading rooms for real-time application and feedback.

- Receiving trade alerts to enhance your decision-making process.

- Mastering the strategies employed by ‘Smart Money’ investors for market success.

3️⃣. Point and Figure Mentorship Course Curriculum:

The Point and Figure Mentorship Course by Wyckoff VSA equips you with comprehensive trading skills through an immersive curriculum. Starting with the essentials of Volume Spread Analysis (VSA), the course advances through strategic use of trading tools and real-time application in live trading rooms.

You’ll learn to interpret market dynamics, detect manipulations, and align your trading strategies with institutional investors. This curriculum is designed to transform beginners into well-informed traders, ready to navigate and profit in the financial markets effectively.

4️⃣. Who is Wyckoff VSA?

Wyckoff VSA is not just a name but a legacy in the trading world, representing a sophisticated blend of the pioneering methodologies of Richard Wyckoff with the modern enhancements by Tom Williams. Rooted in the historic trading tactics of Jesse Livermore, Wyckoff VSA encapsulates a comprehensive understanding of market dynamics.

This educational platform is dedicated to teaching the Volume Spread Analysis (VSA), a technique that deciphers the market manipulations by ‘Smart Money’ and aligns traders with the institutional moves. Through its courses, Wyckoff VSA empowers traders to read the market scientifically, ensuring they trade not just on speculation but with institutional insight.

5️⃣. Who should take this course?

This course is designed for a diverse group of individuals eager to enhance their trading expertise:

- Beginners: Those new to trading seeking a solid foundation in market analysis.

- Experienced Traders: Seasoned professionals looking to refine their strategies with VSA techniques.

- Financial Analysts: Analysts who wish to deepen their understanding of market forces and price action.

- Investment Enthusiasts: Individuals interested in aligning their trading efforts with institutional investors.

6️⃣. Frequently Asked Questions:

Q1: How is market manipulation detected?

Market manipulation is typically detected by analyzing discrepancies in trading volumes, price movements, and historical data. Traders use tools like Volume Spread Analysis (VSA) to identify unusual activity that suggests manipulation, such as sudden spikes in volume without corresponding price changes.

Q2: What is the best volume indicator for trading?

One of the most effective volume indicators for trading is the Volume Spread Analysis (VSA) indicator. It helps traders understand the relationship between volume, price spread, and closing price, offering insights into the balance of supply and demand and potential market direction.

Q3: How do you analyze volume in trading?

Analyzing volume in trading involves looking at the amount of stock, commodities, or securities traded during a given period. Traders look for patterns of high or low volume to predict future movements. High volume often indicates strong interest in a stock, while low volume may suggest less interest or stability.

Q4: What trading platform do professionals use?

Professional traders often use platforms like MetaTrader 4 (MT4), NinjaTrader, and TradeStation. These platforms offer advanced charting tools, automated trading capabilities, and integration with various analytical tools, including those for volume analysis.

Q5: Do professional traders use signals?

Yes, professional traders frequently use trading signals as part of their strategy. These signals, based on market analysis and indicators, suggest potential trading entries and exits. While some traders create their own signals, others subscribe to reliable signal providers to enhance decision-making.

Q & A

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet